Amur Capital Management Corporation Things To Know Before You Get This

Amur Capital Management Corporation Things To Know Before You Get This

Blog Article

The 2-Minute Rule for Amur Capital Management Corporation

Table of ContentsThe Buzz on Amur Capital Management CorporationAmur Capital Management Corporation - An OverviewHow Amur Capital Management Corporation can Save You Time, Stress, and Money.Amur Capital Management Corporation Can Be Fun For EveryoneAmur Capital Management Corporation Things To Know Before You BuyNot known Facts About Amur Capital Management CorporationThe Main Principles Of Amur Capital Management Corporation

A low P/E ratio may suggest that a firm is undervalued, or that capitalists expect the company to encounter extra tough times in advance. What is the ideal P/E proportion? There's no perfect number. However, investors can utilize the ordinary P/E proportion of other business in the exact same market to form a baseline.

The Facts About Amur Capital Management Corporation Uncovered

The average in the auto and vehicle industry is just 15. A stock's P/E proportion is easy to locate on most monetary reporting web sites. This number shows the volatility of a supply in comparison to the market in its entirety. A security with a beta of 1 will exhibit volatility that corresponds that of the marketplace.

A supply with a beta of above 1 is in theory much more unstable than the market. For example, a safety and security with a beta of 1.3 is 30% even more unpredictable than the market. If the S&P 500 rises 5%, a stock with a beta of 1. https://hubpages.com/@amurcapitalmc.3 can be anticipated to increase by 8%

Amur Capital Management Corporation - Questions

EPS is a buck figure standing for the part of a business's earnings, after tax obligations and recommended stock returns, that is designated to every share of common supply. Financiers can use this number to determine just how well a firm can deliver value to shareholders. A higher EPS results in greater share rates.

If a business routinely falls short to supply on incomes forecasts, a capitalist might wish to reconsider acquiring the supply - exempt market dealer. The calculation is straightforward. If a company has a take-home pay of $40 million and pays $4 million in rewards, after that the continuing to be sum of $36 million is divided by the variety of shares impressive

Not known Details About Amur Capital Management Corporation

Financiers commonly get interested in a stock after reviewing headlines concerning its extraordinary efficiency. An appearance at the trend in rates over the previous 52 weeks at the least is needed to obtain a sense of where a supply's cost might go next.

Technical experts brush through substantial volumes of data in an initiative to forecast the direction of supply prices. Basic evaluation fits the requirements of the majority of capitalists and has the advantage of making good sense in the real world.

They think costs adhere to a pattern, and if they can decode the pattern they can take advantage of it with well-timed professions. In current decades, technology has allowed even more capitalists to exercise this design of investing due to the fact that the devices and the information are much more accessible than ever before. Basic analysts think about the intrinsic value of a supply.

The Greatest Guide To Amur Capital Management Corporation

Technical analysis is ideal fit to a person who has the time and convenience degree with data to place unlimited numbers to use. Over a duration of 20 years, annual costs of 0.50% on a $100,000 financial investment will certainly lower the portfolio's worth by $10,000. Over the exact same period, a 1% cost will lower the exact same portfolio by $30,000.

The trend is with you. Numerous mutual fund business and on the internet brokers are decreasing their fees in order to contend for customers. Capitalize on the pattern and look around for the lowest price.

9 Easy Facts About Amur Capital Management Corporation Explained

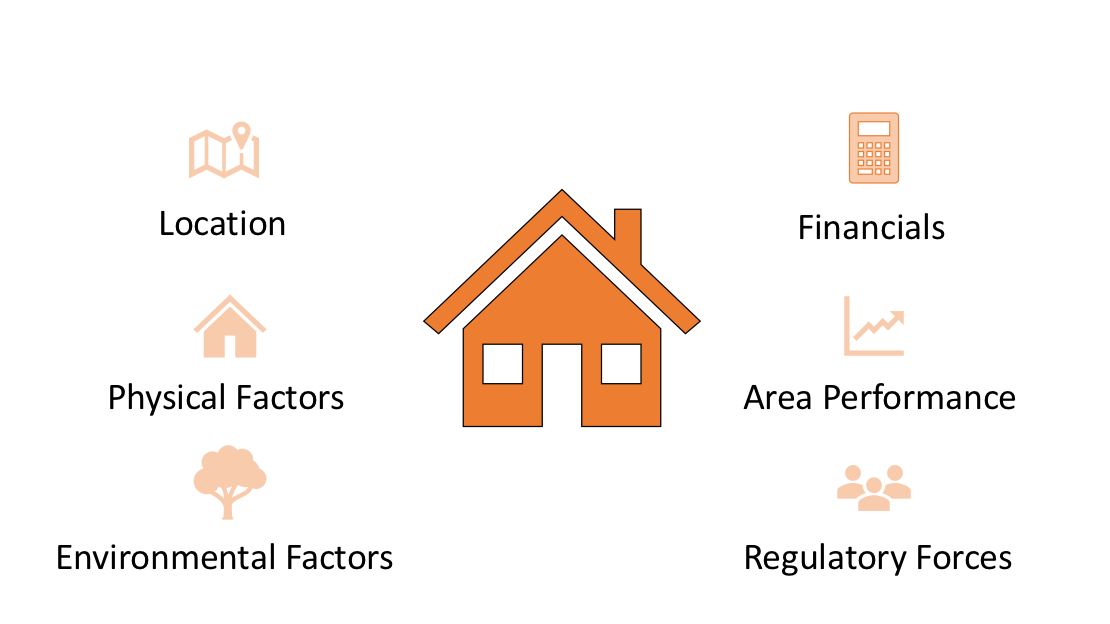

Distance to amenities, green area, panoramas, and the community's condition factor plainly right into property valuations. Closeness to markets, stockrooms, transport centers, freeways, and tax-exempt locations play an important function in commercial building appraisals. A key when taking into consideration home place is the mid-to-long-term view relating to how the area is expected to progress over the financial investment period.

Facts About Amur Capital Management Corporation Uncovered

Thoroughly evaluate the ownership and desired usage of the instant areas where you intend to spend. One means to gather info concerning the prospects of the area of the residential or commercial property you are thinking about is to call the community hall or various other public agencies accountable of zoning and city preparation.

Residential or commercial property appraisal is necessary for financing during the acquisition, sticker price, investment analysis, insurance policy, and taxationthey all depend on real estate valuation. Frequently made use of realty evaluation methods include: Sales comparison method: recent similar sales of homes with similar characteristicsmost typical and appropriate for both new and old homes Cost technique: the expense of the land and building, minus depreciation appropriate for new construction Revenue approach: based anonymous upon predicted money inflowssuitable for leasings Given the reduced liquidity and high-value investment in property, a lack of clarity intentionally may lead to unanticipated results, consisting of economic distressparticularly if the financial investment is mortgaged. This provides routine income and lasting worth recognition. Nevertheless, the temperament to be a landlord is required to take care of feasible disputes and lawful problems, manage occupants, fixing job, etc. This is normally for quick, tiny to medium profitthe typical residential property is incomplete and cost an earnings on completion.

Report this page